Lump sum tax calculator

Learn the alternatives to your pension plan. In addition to saving interest payment youll also repay the loan sooner freeing up extra cash at the end.

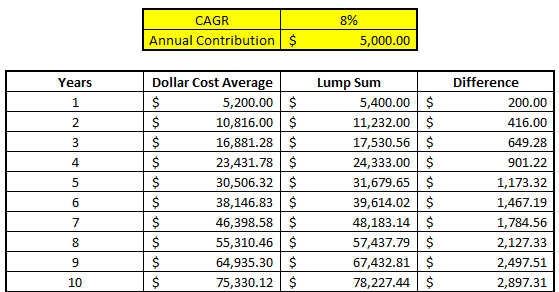

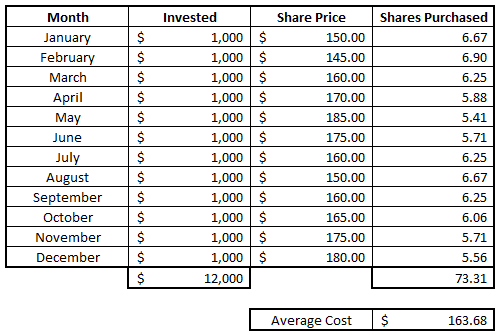

Lump Sum Calculator Investing Now Vs Later With Dollar Cost Averaging

Annuity payment calculator compares two payment options.

. Get the facts your free guide today. The cash lump sum payment is the available jackpot prize pool at the time of the draw. You must use the mathematical formula.

Calculate how much tax youll pay when you withdraw a lump sum from your pension in the 2020-21 2021-22 and 2022-23 tax years. Lets say the severance is for a lump - sum amount of 30000 and the employee works in Pennsylvania. When youre 55 or older you can.

Pension VS Lump Sum Calculator. If you were born before January 2 1936 and you receive a lump-sum distribution from a qualified retirement plan or a qualified retirement annuity you. Receiving a lump sum.

How to calculate the tax payable on Pension Provident or Retirement Annuity Fund lump sums. Federal and state tax for lottery winnings on lump sum and annuity payments in the USA. ATO app Tax withheld calculator.

FV PV 1rn FV Future Value PV Present Value. If taxes apply to that lottery they will be applied to lump-sum payments. Federal Bonus Tax Percent Calculator.

The ATO app includes a simplified version of the Tax withheld calculator for use by employers and workers. Tax calculators Calculate everything you need to know about your tax and how tax affects you. Use the following lump-sum withholding rates to.

Get the facts your free guide today. There are different regulations around how your pension provider will initially apply tax on your pension lump sum dependent on the size of your pension savings and whether you have. This federal bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses.

Lets Partner Through All Of It. If your state does. Choose the tax year lump sum payments will be issued.

To use the Lump Sum Calculator you will need your copy or copies of the Income Withholding for Support PDF for the employee. Ad Build Your Future With a Firm that has 85 Years of Investment Experience. Ad Build Your Future With a Firm that has 85 Years of Investment Experience.

Our lump sum vs. Most DB plans offer the option of a one-time lump sum payment or monthly benefit payouts. Include any Earnings IDs EIDs in the rate that are subject to lump sum.

In the context of pensions the former is sometimes. Combine all lump-sum payments that you have paid or expect to pay in the calendar year when determining the composite rate to use. Use this calculator to compare the numbers and determine how much you can save.

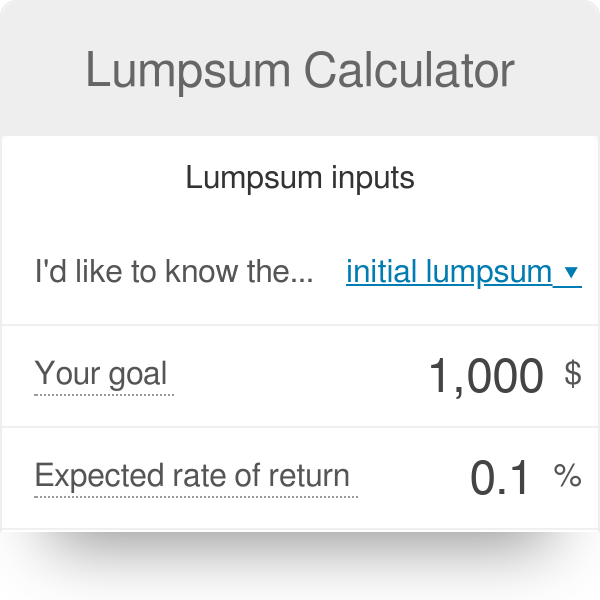

Life Is For Living. The difference is the lottery will first calculate your lump sum gross payout and you pay taxes on. The lump-sum calculator tells you the future value of your investment at a certain rate of interest.

Enter salary rate lump sum should be paid. We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

Find A Dedicated Financial Advisor. It will take between 1 and 2 minutes to use. Ad Learn how a lump sum pension withdrawal may give you more income flexibility.

The annuity option is the advertised jackpot and is the cash lump sum plus interest. You will also need the amount of past-due support the. Find a Branch Contact a Financial Advisor Finras Brokercheck CALL 1-877-579-5353.

Most lottery winners want a lump sum payment immediately. We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. Ad Learn how a lump sum pension withdrawal may give you more income flexibility.

Learn the alternatives to your pension plan. The federal tax withholdings are taken out before receiving your lump sum. Use this calculator to compare the results of getting a lump sum payout instead of a guaranteed monthly pension for life.

Find out what the. The tax is equally divided between you and the employee. How to Calculate Lottery Lump Sum Payout and Annuity Payout By Using Lottery Payout Calculator.

Then they can choose.

Lottery Tax Calculator

Capital Gains Tax Calculator For Relative Value Investing

Consumers Prefer Lump Sum Taxes To Per Unit Taxes Youtube

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

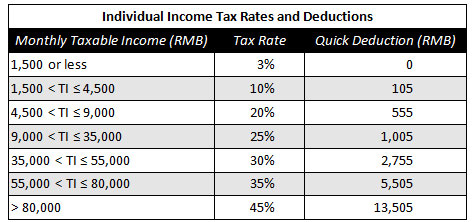

Calculating Individual Income Tax On Annual Bonus In China Updates Dezan Shira Associates

Capital Gains Tax Calculator For Relative Value Investing

Introduction Of Lump Sum Tax Radu Rafiroiu

How Are My Taxes Affected By Receiving A Lump Sum Of Income Www Chadpeshke Com

Lump Sum Calculator Investing Now Vs Later With Dollar Cost Averaging

How To Solve All Kinds Of Tax Multiplier Problems Youtube

Extra Pays Lump Sum Payment In A Pay Run Payroll Support Nz

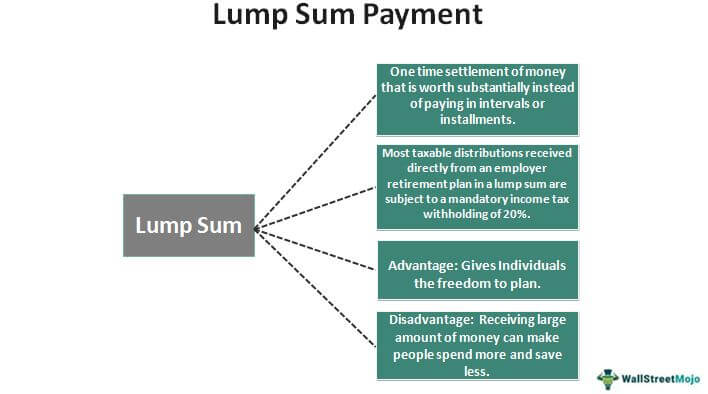

Lump Sum Payment Meaning Examples Calculation Taxes

Lumpsum Calculator

Calculating Individual Income Tax On Annual Bonus In China China Briefing News

Lump Sum Payments To Departing Employees

Lump Sum Calculator Airinc Workforce Globalization

Lump Sum Calculator Airinc Workforce Globalization